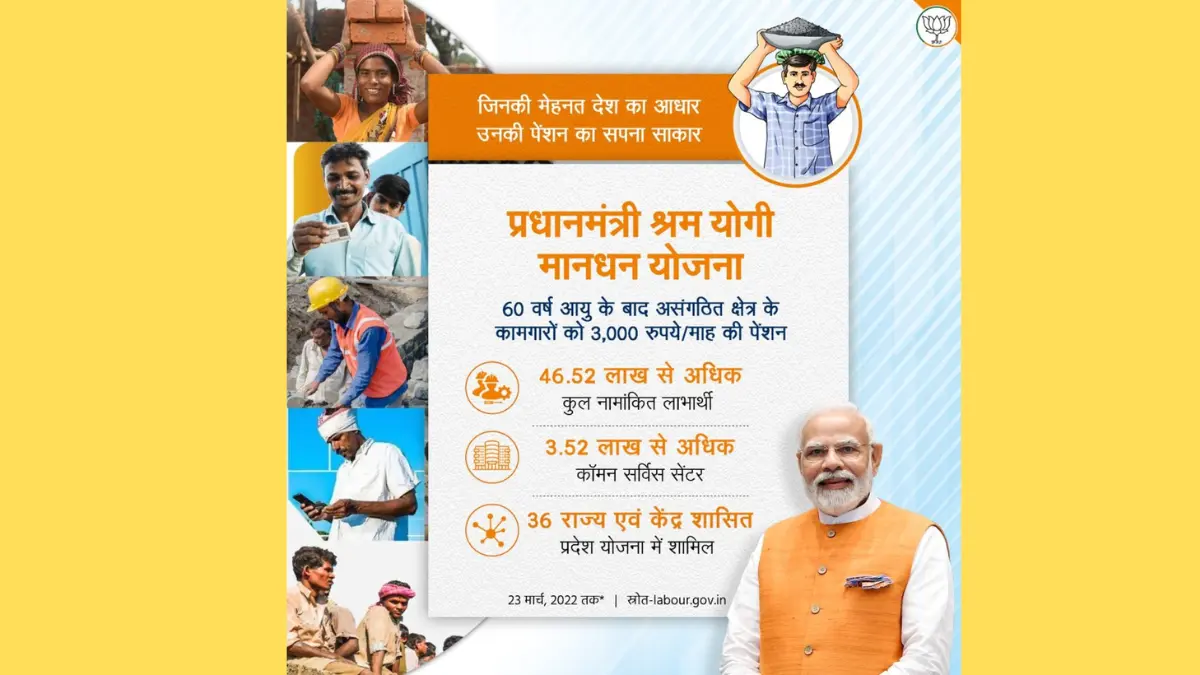

The Indian government has indeed introduced this social security scheme. It is all about assisting the employees in those informal industries across the nation. It essentially provides old age security to millions of employees who cannot really contribute to formal pension schemes.

Important characteristics and advantages:

- Pension: A pension amount of Rs. 3,000 a month shall be provided to every eligible worker upon attaining the age of 60 years.

- Government Contribution: This further supports the contribution received from the worker and increases the accessibility of the scheme.

- Participation in the PMSYM Scheme is based on voluntary participation.

- The applicants may be persons who exceed 18 years of age but not exceed 40 years, have a monthly income that does not exceed Rs. 15,000, and are working in the unorganized sector.

Application Procedure:

The scheme can be accessed through self-enrollment from a Common Service Center or online service portal.

Significance of PMSYM:

The PMSYM plays a crucial role in providing financial security to millions of workers engaged in the unorganized sector, often deprived of benefits from formal social security. This in turn reduces economic inequalities and enhances the overall well-being of workers.

Benefits:

- Reduced Poverty: The PMSYM can reduce poverty among the unorganized sector workers and their family members by providing regular income in old age.

- Improved Quality of Life: The pension will help workers meet their basic needs and improve the quality of life.

- Financial Independence: The plan instills self-confidence among the workers because it offers some level of financial independence and security.

- Social inclusion: what the PMSYM also contributes to is social inclusion because all workers—both employed and the self-employed—are covered by social security benefits.

Opportunities as well as challenges:

- Awareness: Increasing awareness of the PMSYM among unorganized sector workers is crucial for its success.

- Accessibility: This scheme has to be made accessible to all workers because they are not in towns and cities.

Conclusion:

One more commendable initiative is the attempt the government makes, through the Pradhan Mantri Shram Yogi Mandhan Yojana, to furnish necessary security measures for the workforce engaged in India’s unorganized sector. A pension and financial security plan in old age turns the scheme into a vital tool improving general social and economic welfare of the people of the nation.